The Massachusetts Clean Water Trust is preparing to sell approximately $264 million* Series 25 State Revolving Fund Bonds, and $141 million* of Series 2023 State Revolving Fund Refunding Bonds, November 7-8th.

- Preliminary Official Statement

-

Preliminary Official Statement

- Investor Presentation

-

- Ratings Reports

-

About the Financing

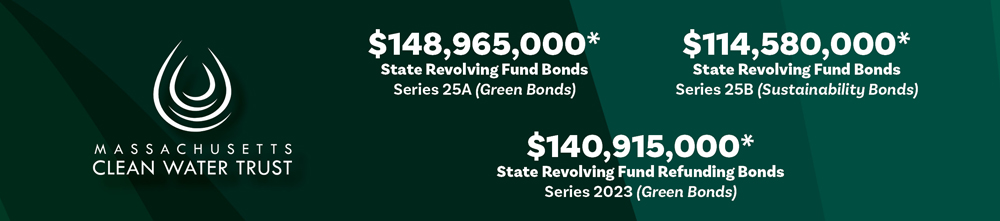

Thank you for expressing interest in the Massachusetts Clean Water Trust’s upcoming financing, which is expected to be comprised of the following:

$263,545,000*

State Revolving Fund Bonds

Series 25

- $148,965,000*

State Revolving Fund Bonds

Series 25A

(Green Bonds) - $114,580,000*

State Revolving Fund Bonds

Series 25B

(Sustainability Bonds)

$140,915,000*

State Revolving Fund Refunding Bonds

Series 2023 (Green Bonds)

Timing and Sizing

Timing and size of the offering are preliminary and subject to change. The Series 25A Bonds, Series 25B Bonds, and Series 2023 Bonds (collectively, the “Bonds”) are expected to be offered to individual investors during a retail order period on Tuesday, November 7th*. The Bonds will then be offered to institutional investors on Wednesday, November 8th*. Individual Massachusetts investors will maintain a first priority on their orders only during the retail order period on Tuesday, November 7th* and may still place orders for any remaining Bonds on Wednesday, November 8th*. For more information on the Bonds, please review the Preliminary Official Statement. This is not an offer to sell nor a solicitation of an offer to buy the Bonds. Bonds may only be purchased through a broker-dealer and in conjunction with the review of the Preliminary Official Statement.

*Preliminary and subject to change.

Syndicate

- Senior Manager

-

- Citigroup | (855) 644-7252

- Co-Senior Manager

-

- Morgan Stanley | (800) 544-5372

- Co-Managers

-

- Bancroft Capital | (484) 546-8000

- Cabrera Capital Markets LLC | (800) 291-2388

- Janney Montgomery Scott LLC | (888) 567-2931

- UBS | (800) 225-2385

- Wells Fargo | (866) 287-3221